Oceans

Investing in blue resilience

From coastal infrastructure and innovative finance to direct investments in nature assets such as mangrove blue carbon projects, we work with companies, investors and philanthropists to create new opportunities that stack carbon, coastal resilience and decarbonization returns on investment, enabling companies and investors to move passive offsetting to active stewardship.

- Strategic ROI:

Direct project investments that align blue carbon offsets with strategic investor and business value (resilience of coastal assets, brand & stakeholder value) - Innovative Finance:

Enabling philanthropy, corporates, investors to connect and co-invest, creating synergies across different investment mandates and products. - Financing Resilience:

Positioning blue carbon projects as part of ESG and regulatory strategies, climate risk adaptation and corporate green finance opportunities.

We are building a resilience portfolio of blue asset classes

Over $1 trillion in coastal assets and tens of millions of people are exposed to coastal climate risks, such as storms, floods and rising sea levels, while 80% of global trade passes through ports vulnerable to climate change.

These resilience risks also open high-value opportunities for solutions that today are undercapitalized. From mangrove restoration and sustainable aquaculture to decarbonised shipping and offshore renewable infrastructure. These blue asset classes already carry a ‘resilience premium’, which can unlock $15 trillion in net value by 2050.

Global investors and companies in coastal, maritime and high-carbon sectors, are well placed to invest in blue carbon as a strategic asset.

A value proposition for long-term investors

Long-term investors, including HNWIs, family offices, institutional capital and collaborating wealth platforms:

- Access investment intelligence with unique foresight. Includes quarterly briefs and curated content linking systemic risks in the blue economy to undervalued, premium blue economy assets.

- Access a strategic portfolio of investment opportunities in premium blue asset classes, curated for catalytic capital, philanthropy, and commercial growth.

- Access exclusive insight events and briefings that explore positions blue carbon projects as part of ESG and regulatory strategies, climate risk adaptation and corporate green finance opportunities.

A pipeline of blue carbon projects to drive resilience

In partnership with Swiss Re Foundation, the Good Energies Foundation and the Global Environment Facility we are creating a blue carbon asset class, that combines local resilience impacts in communities with global investment allocations into rapidly evolving carbon markets.

Through this program, we are building a USD 20 million portfolio of 50 local blue carbon projects across the tropics that are restoring natural infrastructure and building coastal resilience for vulnerable communities; and mobilizing specialized investors, family offices and institutional capital to gain exposure.

Other Programs

Catalytic philanthropy models in Indonesia

We launched the M40 Mangrove Program in partnership with UBS Optimus Foundation in 2022. We are building a global pipeline of blue carbon and mangrove-positive investment opportunities, developing investment pilots to bridge the gap between commercial capital and catalytic philanthropy, and creating a blueprint for mangrove investment at scale.

• A portfolio of investment pilots.

• The 'premium' blue carbon framework.

• A global pipeline of investable projects.

• New private sector leadership models.

Among the pilot projects of our M40 programme, we're working in one of the remaining mangroves sites in North Jakarta, Taman Wisata Alam Angke Kapuk (TWA AK), to bring funders and investors..

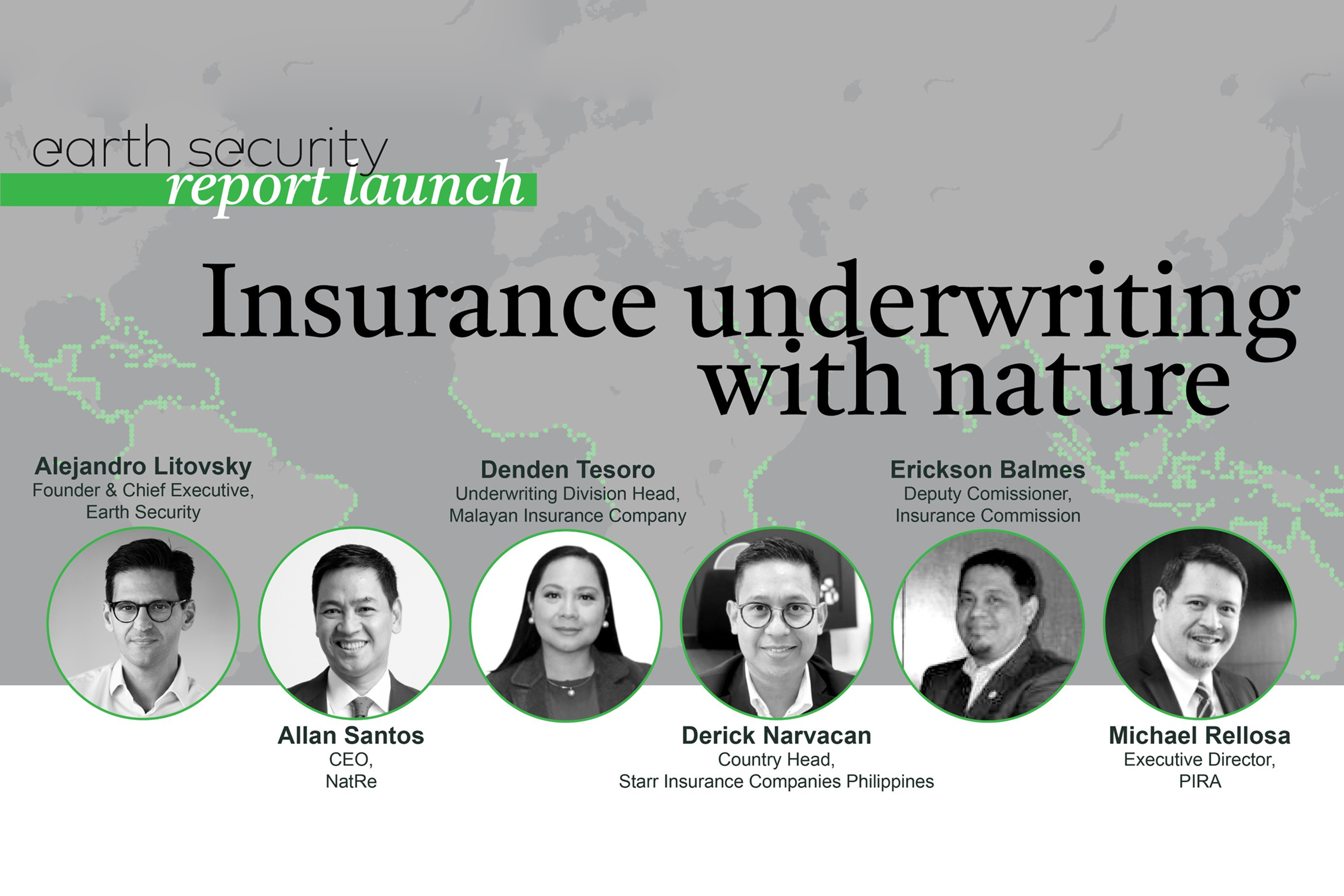

Nature-based Coastal Insurance in the Philippines

From 2020-2023, we brought together a collective of leading insurance companies in the Philippines, in partnership with the Philippines Insurance and Reinsurance Association (PIRA) and the insurance regulator, to explore, support and catalyse the development of insurance products that price the protection value of coastal ecosystems, in particular mangroves, for the industry’s future growth. This mobilized the sector to initiate the development of three products that re-position the country’s coastal natural wealth as part of the industry’s tools to increase its resilience to coastal natural disasters.

In 2017, we partnered with the Philippine Insurers and Reinsurers Association (PIRA), to explore how NbS could be incorporated into the industry’s climate resilience strategy. We are delighted to share that PIRA is now moving....

A Blueprint for a ‘Mangrove Bonds’ in Australia

From 2021-2022, we worked in partnership with HSBC Australia and a collective of local financial institutions and blue economy experts, to explore the opportunities and viable design options for creating a Mangrove Bond in Queensland, Australia. As part of the program we created a local implementation partnership and catalysed collaboration between coastal

infrastructure companies and project developers to take the blueprint into action in selected locations.

Coastal ecosystems provide over $1 trillion in flood protection benefits — yet remain critically underfunded. Investing in nature is investing in resilience.

Our Intelligence

Our thought leadership anticipates what’s next. Our quarterly briefings keep investors and companies one step ahead, translating trends into strategic opportunities.

News

FUNDERS

Partners

Together with strategic partners our work is driving a new generation of asset classes with the power to transform how capital markets value and invest in ocean and coastal resilience.

Get in touch

If you’re an investor looking for opportunities, or a project looking for funding, get in touch to discuss how we could work together.

.jpg)